Watch the recording of the training session HERE

Read: A master gave each of his three servants a sum of money. The amounts were set according to each servant’s previously demonstrated capabilities. The man then left for a long time. When he returned, he asked each of these servants to report what he had done with the money. The first two servants revealed they had doubled his investment. “Well done, thou good and faithful servant: thou hast been faithful over a few things, I will make thee ruler over many things: enter thou into the joy of thy lord,” was the master’s reply (Matt. 25:21-23). The 3rd servant was afraid and buried his talent in the earth. The Lord was not happy with the third servant…not because he did anything wrong, but rather because his fear had prevented him from doing anything at all.

Discuss: In what ways can fear prevent us from doing good with our gifts and abilities?

Share with the group: What did you learn by keeping separate records for your business and personal money?

THE DIFFERENCE BETWEEN PROFIT AND CASH FLOW

Read: You have learned that business success requires daily record keeping. Every time your business receives or makes a payment, you need to record it. You have also learned how to create an income statement, which shows a summary of the profit (or loss) achieved by your business over a specific period of time.

Profit is defined as the money left over for your business after you subtract your expenses from your revenue. While profit is an important metric, it’s not the only one that demands your attention as a business owner.

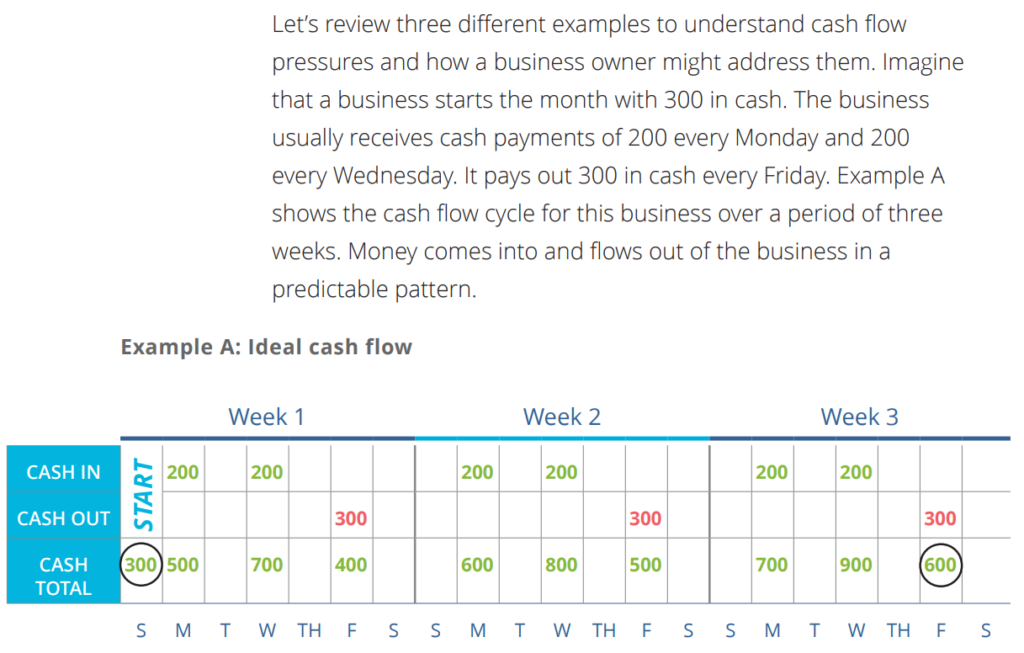

Cash flow is a metric that focuses on the timing of the movement of money in and out of your business every day. Cash flow is the lifeblood of your business. When your business has cash available, you can pursue options for growth, make investments, and save money for unexpected situations or emergencies. Your income statement might show that your business is profitable, but it will go bankrupt if it doesn’t have enough cash to pay its obligations. Cash flow problems are one of the leading causes of business failure.

Video: How-much-cash-is-available (below)

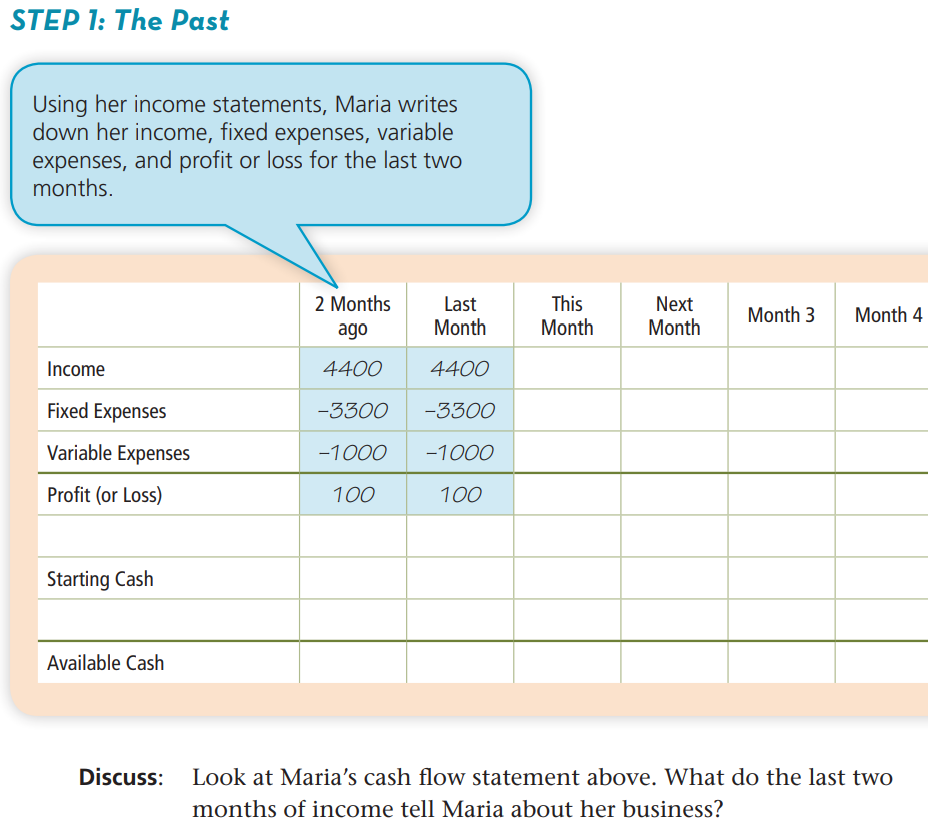

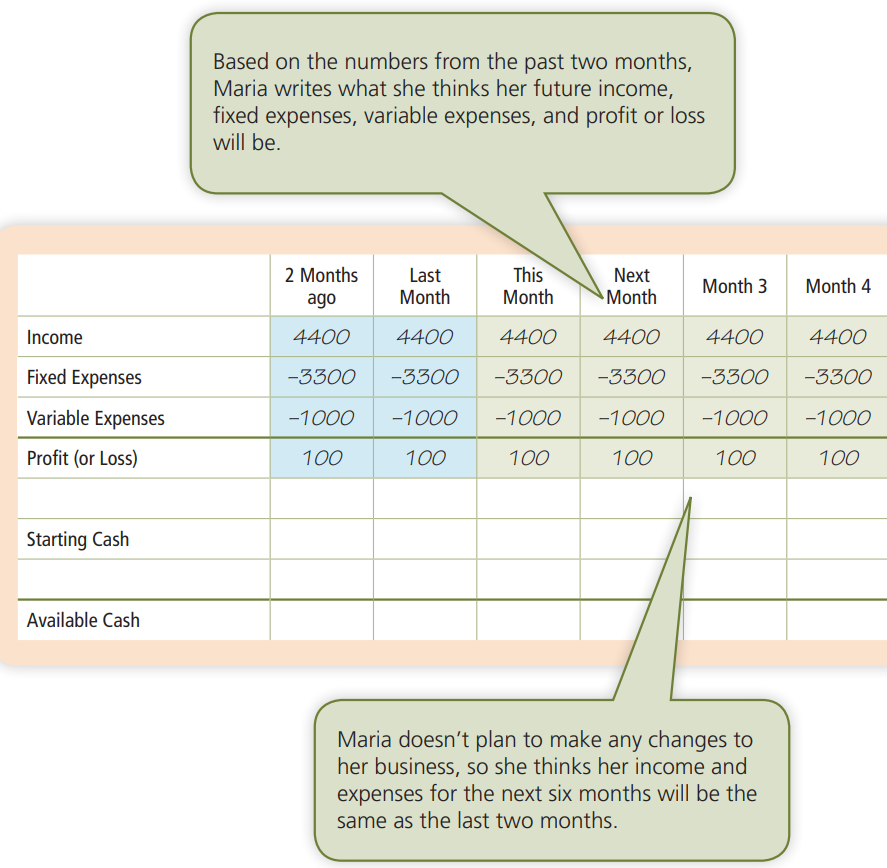

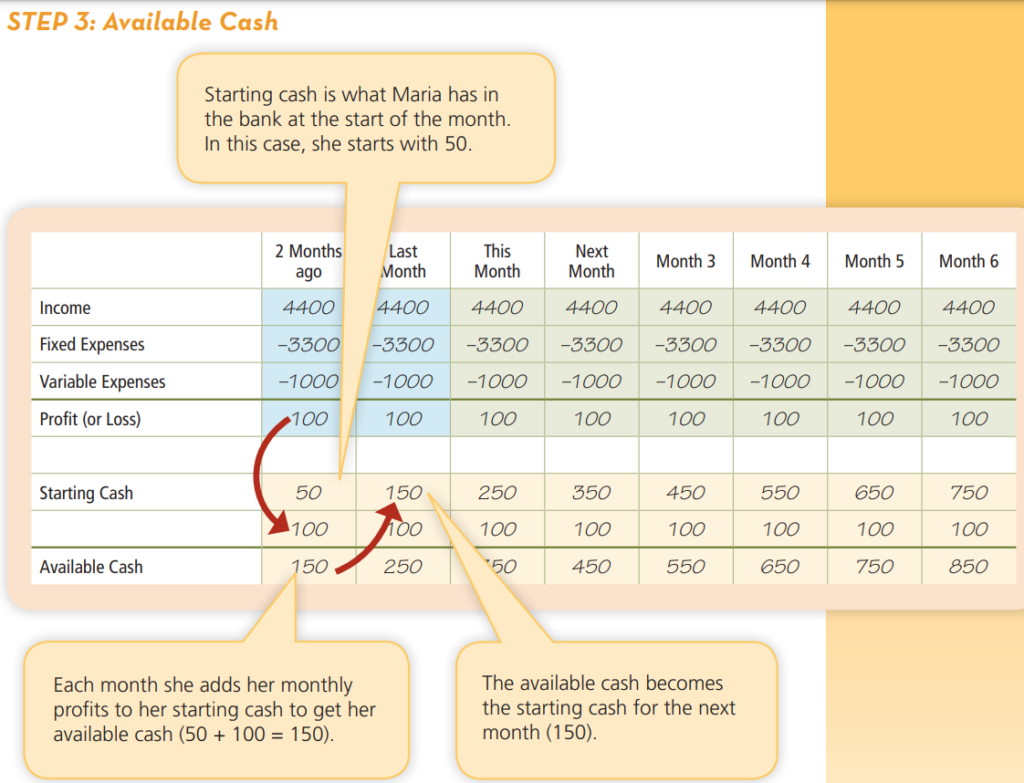

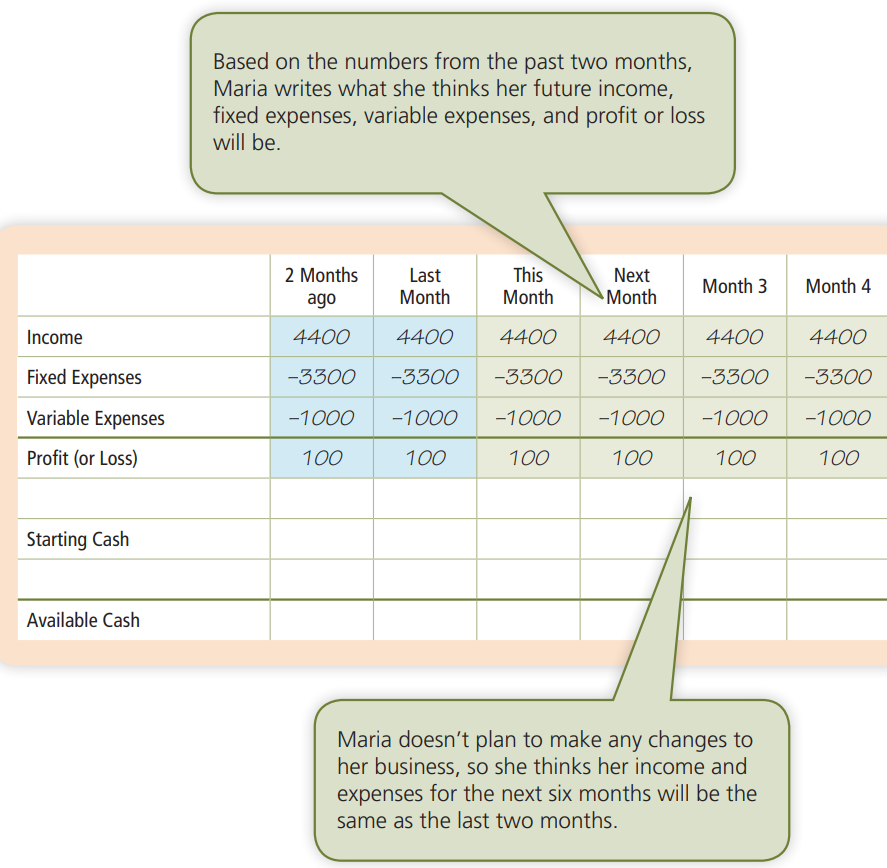

Read: To know if Maria has enough cash to grow her business, she needs to know three things: the past, the future, and the cash flow. She can find out these three things by creating a cash flow statement.

Discuss: Look at the cash flow statement above. How much money does Maria have available at the end of month six?

Answer = 850

Read: There are two types of cash flow:

Positive cash flow occurs when the total amount of cash coming into your business during a specific period of time is greater than the total amount of cash leaving your business during that same time. This is what you want: a positive cash flow.

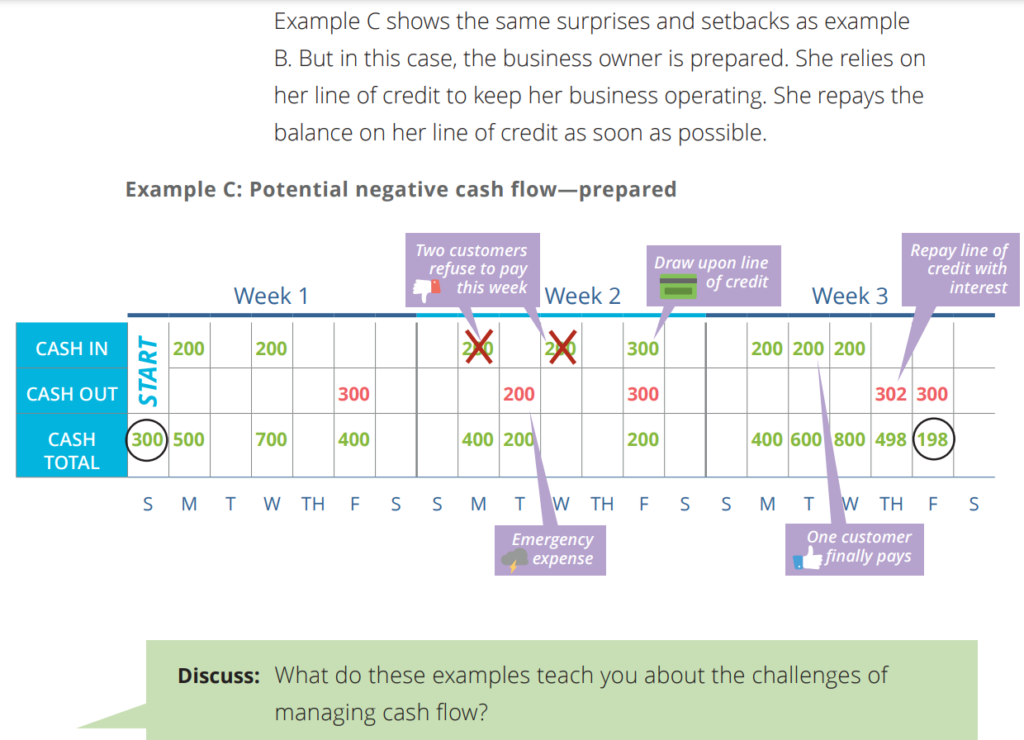

Negative cash flow occurs when the total amount of cash leaving your business during a specific period of time is greater than the amount of cash coming into your business during that same time. This is a risky, undesirable situation that you should address immediately with actions that generate cash as quickly as possible and reduce costs.

It’s common for business owners to have cash flow challenges. Some of these challenges include:

- The newness of the business, which makes it difficult to receive and pay on credit.

- Growth opportunities, which can reduce the amount of available cash.

- Having inventory, which ties up cash.

- Customers paying on credit, which delays the amount of incoming cash.

- Selling to other businesses that pay on credit, which delays the amount of incoming cash.

- Uneven sales due to seasonality or other factors, which can create peaks and valleys in the amount of cash you have.

- Unexpected expenses.

- Nonpayment by customers (bad debt).

Discuss: What potential challenges do you anticipate with the cash flow of your business? Write them in your notebook.

Step 1: As a group, review the following strategies for improving the cash flow of your business. Pause after each bullet point to identify the pros and cons of these strategies to get paid quickly.

○ Offer discounts to customers who pay early. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Consider implementing a late-payment charge. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Either don’t offer payment on credit, or establish strict terms for payment on credit. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Accept credit card payments. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Issue invoices promptly. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Create an accounts receivable (collections) follow-up plan. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Offer automatic bill payment to customers. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

Step 2: As a group, review the following strategies for conserving cash. Pause after each bullet point to identify the pros and cons of these strategies to conserve cash.

○ Pursue a business opportunity with few very few fixed costs (like rent, machines, or employees). What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Cut unnecessary expenses. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Hold very little inventory of unsold product. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Wait to pay your own expenses until a few days before they are due. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Negotiate delayed payment terms with suppliers if necessary. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Maintain a cash reserve. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

○ Obtain a loan or line of credit to borrow from during periods of uneven cash flow. What are the pro’s (positive aspects of this strategy)? What are the con’s (negative aspects)?

Step 3: Individually write answers to the following questions:

What actions could you take to speed up the flow of cash coming into your business?

What actions could you take to slow down the flow of cash leaving your business?

ACTIVELY MANAGING MY CASH FLOW

Read: As explained earlier, cash flow is the timing and amount of cash that flows in and out of your business during a specific period of time. It’s not enough to occasionally check your business bank account and hope that the numbers work out. You need to carefully watch the cash flow of your business. You should know how much cash your business has available in the future. You need to write down and continually update your cash balance including future expenses (a forecast of future cash flow). Your forecast should show your expected cash flow for the next few months. Your forecast won’t be 100% accurate, but it’s important that you plan for your current cash position and future cash flow forecast. Successful business owners keep a cash savings for unexpected expenses.

Individual Activity

Make a list of potential cash flow challenges your business may face. Write the list in your notebook along with the strategy you will use to avoid running out of cash if the challenge actually happens.

MY COMMITMENTS

Ⓐ I will pay myself a salary or wage and keep my business money in a separate account from my personal money.

Ⓑ I will keep separate records for my business and personal money.

Ⓒ I will continue to use a revenue and expense log every day to track the sales and expenses from my business or the test products I am selling to learn more about the market and customers I plan to serve. Use the template below.